Olga Gopkalo, Alexander Goloviznin. «The Russian market keeps growing»

In terms of new passenger car sales, Russia takes second place in Europe (following Germany) and seventh in the world (between India and France). According to forecasts published by BDW Automotive, by 2014 Russia will become the largest car market in Europe.

The mature European market is stagnant. The new car sales volume has been falling for almost 2 years now. The European Automobile Manufacturers’ Association announced that in QII 2013 nearly 6.5 mln new cars were sold in Europe (EU-27 + EFTA), which constitutes a 6.7% year-on-year decrease. In Russia, on the other hand, according to PricewaterhouseCoopers (PwC), the market has now entered a path of constant, moderate growth, after several years of strong volatility. The main negative factors affecting the Russian market are rather of a short-term nature; positive factors, on the contrary, can be observed in the longterm. These include a low motorization rate with a high potential for growth, a high average growth of the automobile fleet with an increasing substitution rate, relatively stable oil prices, as well as foreign automobile manufacturers’ investments in production arrangements on the territory of Russia. Therefore, regardless of the instability anticipated in the forthcoming years, passenger car sales are expected to grow in the long run. PwC estimates the Russian market volume to reach 3.7 mln by 2025 while, according to ASM Holding, this is going to range between 3.2 and 3.7 mln per annum. On the other hand, both MIP – a Russian consultancy providing analysis of automotive market – and Rolf Group – Russia’s major car seller, forecast sales to hit 3.2 mln already by 2015.

The evolution of automobile logistics in Russia

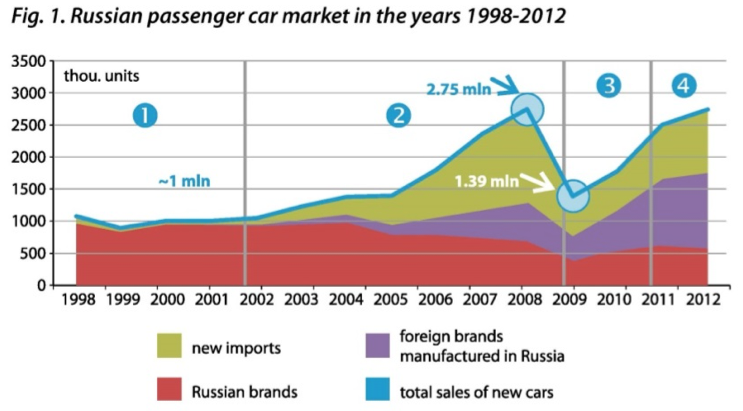

The sector of automobile logistics in Russia reflects the automotive market demand. In the period between 1998 and 2012, the country’s market of new cars (and of automobile logistics) experienced significant ups and downs, its dynamics of growth showing several distinct stages.

By the beginning of the 2000s, the market of new passenger cars in the RF was relatively stable, with annual sales close to 1 million vehicles, with Russian brands accounting for some 90%.

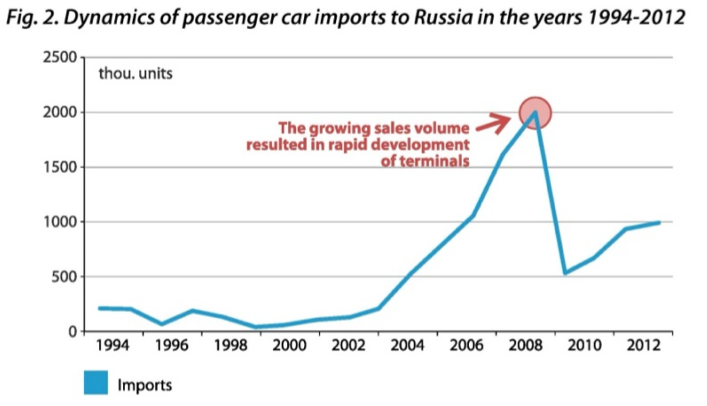

The period between 2002 and 2008 witnessed significant growth with a snowballing increase from 2005 on, by 20-30% yoy. The peak with 2.75 mln vehicles sold was recorded in 2008. This was also when the supply of Russian-made cars began decreasing, giving way to local production of foreign brands in the RF. The most spectacular growth, however, was observed in the imports volume – increasing more than 10 times. Existing transport infrastructure turned out to be far too insufficient to handle such high traffic.

The explosion of imports noted in the years 2004-2008 was even greater than the sales growth, owing to used cars imports. The peak volume of 1.9 mln imported vehicles was observed in 2008. Within a 5-year period imports increased by four times, leading to deficiency of such transport infrastructure facilities as sea terminals, the fleet of road and rail car transporters and autoracks.

The first batches of new cars imported via Baltic ports arrived in December 2006, initially – to jetties and yards of the Port of St. Petersburg adapted for the new purposes. Both in the Petrolesport complex in Saint Petersburg and in the Yug-2 terminal in Ust-Luga, transhipment of cars commenced in 2008.

In 2009, the financial recession reduced the volume of cars sold in the RF by half. The segment of foreign brands manufactured in Russia suffered less, dropping 38%, while imports fell by 57%. Batches were held in European terminals – vehicles were not brought to the RF territory in order to avoid paying import customs. Furthermore, delivery routes have been changing (e.g. a new transit yard was built at Sillamäe), new land terminals have been constructed. The fleet of car transporters has been reduced on a mass scale.

Since mid-2010, the market has begun recovering, firstly owing to the growing sales of vehicles manufactured in Russia (both domestic and foreign brands). The fleet of road and rail car transporters is deficient again. Nevertheless, the rate of market growth (with the exclusion of the low base effect of 2009) still remains below the prerecession levels.

The significant growth in demand for cars, public programmes intended to stimulate the market, as well as automakers’ investments in new production capacities resulted in a considerable increase in output.

In 2011, the production of passenger cars increased by 45% against the 2010 volume, exceeding 1.7 mln. In 2012, the output was higher than 2 mln vehicles. The production volume which was reached is an absolute, historical maximum.

Domestic production growing, sales and imports slowing down

In February 2011, new regulations governing the operation of foreign automakers in Russia were enacted.

The document allows manufacturers to import car components at very low or no customs duty rates but, in exchange, it requires them to start an annual throughput capacity of 300-350 thou. vehicles, with a 60% rate of manufacturing localization (until 2018) and to invest in research and development.

The semi knocked-down is limited to 5% of the total output and cannot last longer than two years.

The new restrictions on the industrial assembly of cars force foreign manufacturers to increase their production volumes. With the existing capacities, automobile plants are already able to exceed 1.5 mln foreign brand vehicles per year and automotive companies are planning to further increase their manufacturing capacities.

The far-progressed process of manufacturing localization has given rise to the development of automotive components production in the country. For example, Volkswagen Group is building a factory in Kaluga Oblast, not far away from an existing car assembly plant belonging to the company.

A Canadian automotive supplier, Magna International Inc., is planning to build an industrial complex with a capacity of 250 thou. vehicles in Kaliningrad Oblast.

In December 2012, the Renault-Nissan Alliance signed an agreement with the state-owned corporation Rostechnology to set up a joint venture named Alliance Rostec Auto BV. The new company is expected to supply up to 1 mln of Lada, Renault and Nissan cars per year until 2020. Production of Nissan Almera cars has already commenced.

The list of car models manufactured by foreign automakers in Russia is getting longer almost every month. Their market share is constantly growing too. New plants are also being built in the RF’s Far East.

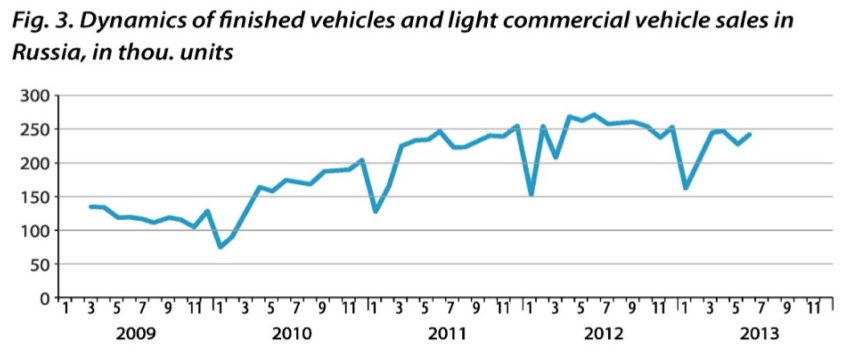

Nevertheless, the growth of domestic production is accompanied by stabilization of the sales level. In 2011, the Russian automobile market expanded by 39%, up to 2.65 mln of passenger and light commercial vehicles. November 2012 was the first month in almost two years with stagnation in car sales. Thereafter, following some minor fluctuations, the sales volume regained the level of 2011.

Irrespective of the growing production, passenger car imports can be expected to remain substantial – up to 25%-30% of the sales volume or, depending on the sales forecast, from 800 to 900 thou. vehicles.

This is owing to the wide range of models offered by manufacturers: models not manufactured in the RF will be imported. Furthermore, imports can be stimulated by the expected customs duty reduction (from 30% to 15%) in 2019, due to Russia’s accession to the WTO.

Changes in the geographical makeup of production lead to changes in logistics

The growth in local production is followed by greater demand for internal transportation. Moscow and St. Petersburg are reaching stabilization in terms of demand for vehicles and any further growth will be due to the motorization rate growth in the regions. This will also lead to the development of transport.

The domestic transport market determines prices of logistics services – while earlier domestic prices were “adjusted” to the reference cost of delivery from a Finnish port, now it is often the other way round: prices of import logistics are set based on domestic transport tariffs. Despite this, with an insufficient fleet of car transporters and specialised rolling stock, seaports and inland shippers are competing for transport providers.

Automobile plants in Central and Eastern Europe are mostly export-oriented. In the period from 1997 to 2012, the total output of passenger cars in the three countries most distant from seaports – Hungary, Slovakia and the Czech Republic – increased from 438.3 thou. to 2,287.2 thou. vehicles, i.e. more than five times. Export from these regions enters Russia via land border crossings.

With new assembly plants opened in south-eastern Europe and in Turkey, a southern sea entrance is needed. Since 1997, the output of cars in Turkey has nearly doubled: from 242.8 thou. to 576.6 thou. passenger cars (in 2011, 639.7 thou. vehicles were produced). Short-term goals of the Turkish automotive industry include achieving an annual output of 2 mln motor cars, 1.5 mln out of this volume to be exported. Moreover, Turkey is planning to deliver 4 mln vehicles per year by 2020, with exports at a level of 3 mln. Russia is considered to become one of the target markets, with an export volume between 30 to 60 thou. cars.

In Romania, the annual output of passenger cars increased nearly three times within 15 years (109.2 thou. in 1998 and 326.6 thou. in 2012). In addition to local brands, Renault, Ford, Hyundai are produced here. More than 90% of this production volume is exported.

Also, Asian producers are considering the possibility of using Black Sea routes to import cars, bearing in mind the shorter freight distance and the vicinity of some regional sales markets in the RF.

The need for automobile cargo handling facilities in Black Sea ports has rapidly grown owing to the development of the export-oriented production in Turkey. In addition to automobile handling at “NUTEP” terminal in Novorossiysk (46.8 thou. cars in 2012) two new terminals have been launched in this port. One was commissioned at September 2013 by Delo Group in partnership with Rolf SCS. This terminal is capable of handling 50-70 thou. cars per annum and has parking space for 1565 cars. Another project was announced in 2013 by NCSP Group in partnership with GEFCO. New cars are handled at berths of Novorossiysk Ship-Repair Yard. It is planned to receive about 30 thou. cars annually.

Baltic ports more attractive

With the current level of prices, Baltic ports are the most attractive for the importation of cars manufactured in Asia. Economy of time and, consequently, inventory cost, namely the cost of resources withdrawn from operation in the period when a vehicle has left the manufacturer, but has not yet been sold and is on its way. This is the only advantage of Far Eastern ports.

Furthermore, one should be aware of the Far Eastern delivery channel’s limited throughput capacity, which is determined by the existing supply of the rolling stock required by manufacturers. This is coupled by railway transportation security problems, including thievery and mechanical damage.

Car exports in recent years from the EU to the RF reached some 500 thou. vehicles, with a major part of this volume coming via Baltic ports or land routes, due to the geographic structure of the automotive industry in Western Europe. Ports of the Far East mainly specialize in handling used cars and not all terminals are capable of receiving new vehicles as, in this case, requirements concerning the standard of services and facilities are essentially different.

Fig. 4. Automobile plants in Europe

Terminals’ cargo handling capacities are concentrated in Ust-Luga and in the Big Port Saint Petersburg. Currently, a tendency is observed to build state-of-the-art terminals. There are two terminals in the Port of Ust-Luga: Yug-2 and No-vaya Gavan.

Yug-2 car terminal, with its annual turnover capacity of 500 thou. vehicles, comprises three berths designed to receive PCC & PCTC vessels with a draft from 8.8 to 11.0 m and straight stern ramps. The berths are capable of accepting direct deepsea calls from Japan and Korea. Currently, Yug-2 is the most modern, state-of-the-art, multi-purpose terminal on the RF territory, with fine-tuned production processes, an IT-system, qualified staff and experienced management. This is the only operational sea terminal where the owner and the operator is the same.

In November 2012, the Russian Transport Lines group inaugurated No-vaya Gavan car terminal in Ust-Luga, with an initial annual throughput capacity of 250 thou. vehicles. Currently, Novaya Gavan covers an area of 64.87 ha of land but can be extended up to 193.12 ha. The storage yard offers 4,590 parking lots (the designed target capacity being 19,290 vehicles). The first berth is capable of unloading ro-ro vessels with side and rear ramps (mark of dredging – 9.4 m, berth wall length – 150 m). In 2013, another berth is planned to be launched (9.6 m of depth). As of today, the terminal is capable of handling vessels up to 2,000 CEU.

Completion of the third stage of Novaya Gavan terminal’s development is planned for the year 2014. With a 12 m berth wall, the terminal will be capable of accepting ocean-going vessels (up to 5,500 CEU).

The Big Port of Saint Petersburg was Russia’s first Baltic seaport to offer automotive transhipment services. Currently, there are four car terminals there, with another ro-ro facility in progress).

The Petrolesport car terminal is controlled by Rolf SCS, a member of Rolf Group (a Mitsubishi importer and auto dealer for many other car brands). The contract with Petrolesport will expire in 2016. Petrolesport’s ro-ro terminal is capable of handling up to 190 thou. passenger cars and 40 thou. other ro-ro car-go units per year. Two berths are fitted with unloading facilities for ro-ro vessels with straight stern ramps: berth No. 46/47: length – 323.13 m, depth – 12.07 m; berth No. 60: length – 160.9 m, depth – 7.58 m.

In early 2009, the first stage of a ro-ro terminal development project was completed by Perstiko (incorporated in Sea Port of Saint-Petersburg, a large stevedoring company in the Big port of saint-Petersburg) in the area of berths 36-37 (annual transhipment capacity of 790 thou. tn). Terminal facilities are capable of handling all types of ro-ro cargo, sometimes receiving car shipments (Seat, Fiat LCV, etc.). Ro-ro vessels are unloaded at berth Nos. 36-37 (vessels with stern and side unloading facilities, ramp width – 30 m) and berth Nos. 17-19 (side ramps), depth range from 9.6 tо 11.0 m.

Another car terminal is located on the berths of the former Third Stevedoring Company, which is now a part of Sea Port of Saint-Petersburg. The terminal operated by BLG Logistics was opened in 2008, its annual throughput capacity reaches 80 thou. cars. Berth No. 67 (162 m long, 7.6 m deep) is capable of receiving vessels with quarter, side or slewing stern ramps.

Russian Transport Lines operates a terminal created on the basis of the Sea Fishery Port «Morskoy Rybnyi Port» and Onega terminal – 160 m2. The terminal is capable of receiving ro-ro vessels with various unloading ramp types, including straight stern facilities. Cars are unloaded in berth Nos. 1-2 with a total length of 257.5 m and depths ranging from 7.6 to 8.9 m.

A new terminal is being constructed by Fenix, a Forum Industrial Group member in the Port of Bronka (Port of Bronka is a new district of Big Port of Saint-Petersburg). Terminal commissioning is planned for the years 2013-2015. The 27.1 ha terminal, with a designed capacity of 260 thou. units (150 thou. units – imports, 110 thou. units – exports) per annum, will be capable of receiving ro-ro vessels with a straight stern ramp and other types of unloading facilities. The technical feasibility of a 2-level loading/unloading operation is being considered.