Olga Gopkalo. «A closer look». Tendencies on the fertilizer transshipment market in Eastern Baltic ports in 2013

Fertilizers are one of the most important cargo groups for Baltic Sea ports. Their share in the total cargo handled in Eastern Baltic ports is close to 7%, the Port of Klaipėda being the leader of this market. Its three major terminals, serving the Lithuanian chemical industry’s export, attract Belarusian and Russian transit as well.

In 2013, 8.52 mln tn of fertilizers was transloaded in Klaipėda. The sales market redistribution between Belaruskali and Uralkali resulted in a drop in the transshipment Belarusian of fertilizers by 12.4% this year, i.e. 1.21 mln tn. Although less in volume, this cargo group still remains the most popular one in the Port of Klaipėda, accounting for 25.6% of the port’s total throughput.

The Big Port of St. Petersburg took second place in terms of turnover in this category of cargo. In 2013, 6.02 mln tn of fertilizers was exported this way, a major part of these were handled by the Baltic Bulk Terminal owned by Uralkali. Fertilizers were also transloaded by the Sea Port of Saint-Petersburg.

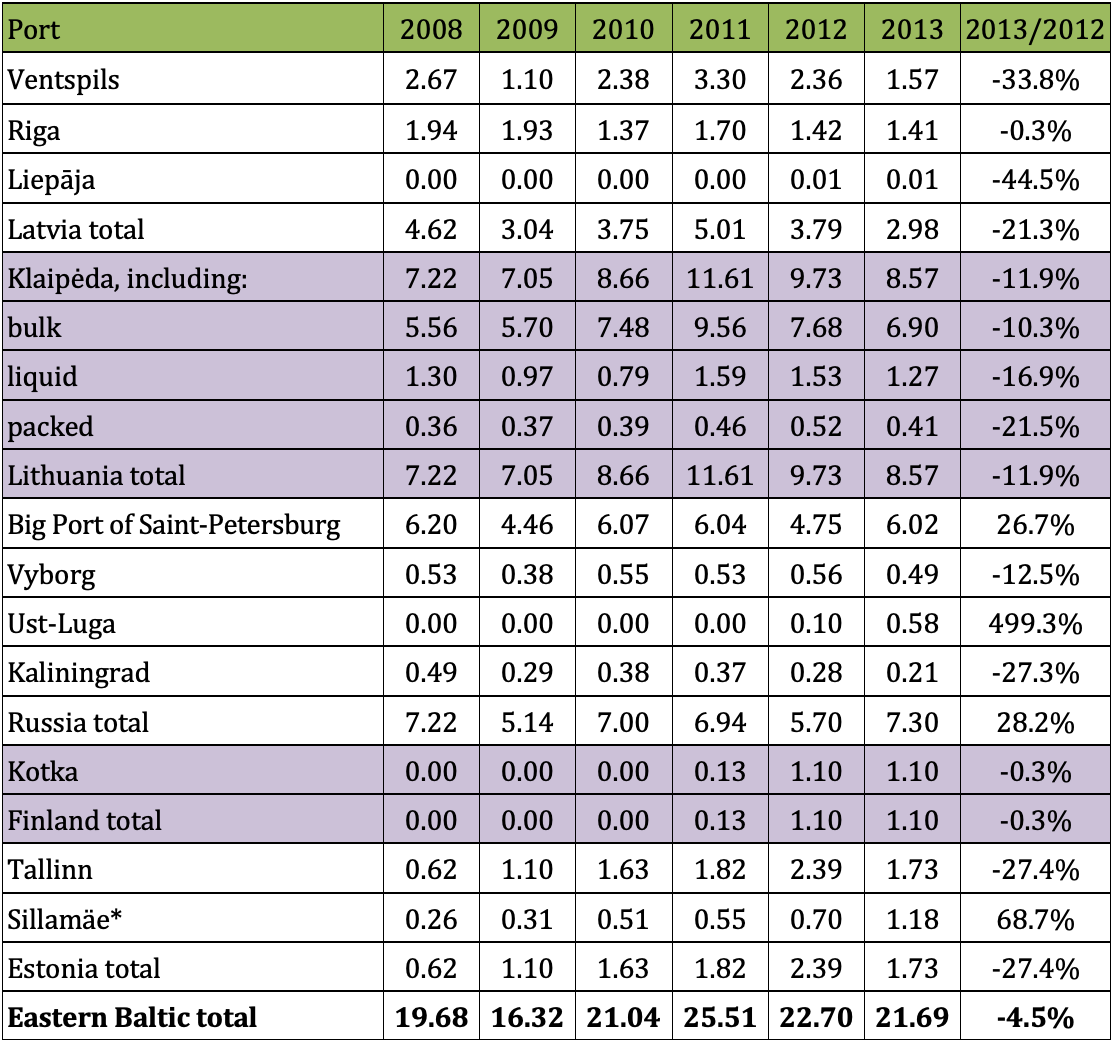

Ventspils and Tallinn share the next two positions, although proportions between them keep changing year by year. In 2013 Tallinn moved up, but both ports suffered a serious drop in the volume of fertilizer transshipment (see Table 1).

Tab. 1. Transshipment of mineral fertilizers in Eastern Baltic ports (mln tn)

*As no statistics on fertilizer transshipments are available for the Port of Sillamäe, the cargo turnover has been estimated based on port-bound railway shipments.

In total, a distinct tendency could be noted in 2013: a drop in this cargo category was recorded by all ports, except the most attractive Russian Baltic ports: Ust-Luga and Saint Petersburg and the Estonian Port of Sillamäe, situated approximately 30 km from the Russian-Estonian border. In terms of growth rate, this port is a leader. Two liquid cargo terminals: AS BCT and TankChem are owned by the Russian holding company Acron and by EuroChem, respectively. Acron is increasing its deliveries to the Port of Sillamäe. However, the increase is not only due to liquid fertilizers, it is also owing to dry products of Phosphorit Industrial Group (part of EuroChem Group SE) handled here since 2013.

Who is the main player here?

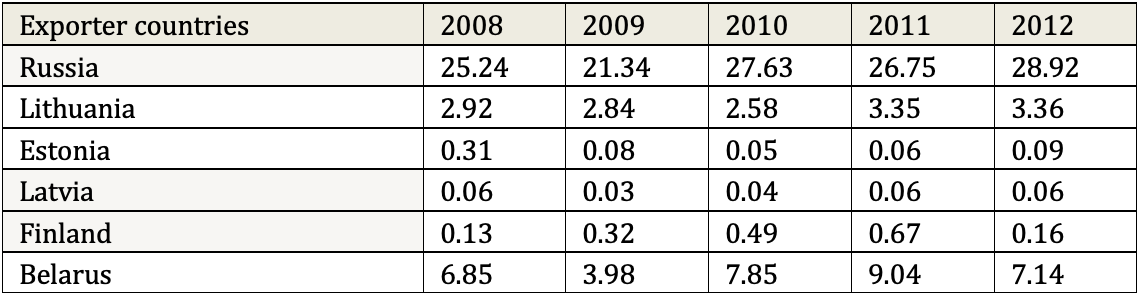

Estonia, Latvia and Finland are exporting insignificant volumes of fertilizers, Russia and Belarus remain the main driving forces of this market in the Baltic Sea region (certainly, some part of the export volumes shown in Table 2 are shipped to ports in the south). Fertilizers are also exported by Lithuania, but this country’s exports are “bound” to its own ports and terminals (Klaipėda).

Tab. 2. Exports of mineral fertilizers in Baltic Sea region (mln tn)

Russia is the key client on Baltic fertilizer stevedoring market. According to official statistics of the Russian Federation’s Ministry of Transport, the transit of Russian fertilizers to ports in the Baltic States (Latvia, Lithuania, Estonia) has recently been showing a growing tendency, with a downturn reflecting the general decrease in exports in the crisis year 2008. The maximum level 8.1 mln tn (~44% of the fertilizers volume transloaded in the ports of the Baltic States) was achieved in 2011.

«The Potash Bubble»

To gain a better understanding of the situation, it is necessary to analyse the market by fertilizer types (nitrogen-based phosphorus-based, mixed, potassium-based). Russia and Belarus are among the world’s biggest suppliers of potassium fertilizers. These two countries’ exports hit the historical maximum level of 16.9 mln tn in 2007, with the global market reaching 44 mln tn (the combined share of Russia and Belarus was close to 38% of the global market).

In the same 2007 pre-recession boom, the total exports of mineral fertilizers from the Eastern Baltic region (Latvia, Lithuania, Estonia, and Finland), Rus-sia and Belarus added up to 39.2 mln tn, the potash segment accounting for 43% of the exports. Yet, namely this part, while most substantial, is the most volatile one at the same time. This is due to the potash market’s nature: its high concen-tration (six major companies control 85% of the global market), as well as the fact that the application of potassium-based fertilizers does not have a similar, immediate effect on crops as is the case with nitrogen-based substances. This is the main reason why demand in the nitrogen segment is much more stable, while the potash market is subject to significant ups and downs.

There are two key suppliers of potash on the post-Soviet territory: Russian Uralkali and Belarusian Belaruskali. Until 2013, the companies used to follow an agreed sales policy, with a majority of their deliveries going to their export markets, traded by their joint venture – Belarusian Potash Company. However, after an international scandal, when Vladislav Baumgertner, the Uralkali Gen-eral Director was arrested in Minsk, the hitherto business partners stopped their collaboration, went straight into open competition and began remodelling their export logistics. For the time being, it is hard to anticipate how this situation will affect the stevedoring market, but some tendencies are already perceptible. The break between the two leading producers was a shock to the already falling market. Since July 2013, Uralkali has been selling to the international market solely via its own trader – Uralkali-Trading. Furthermore, the company has revised its trading strategy and announced its transition to a “volume over price” policy. The plans provide for an annual output of up to 19 mln tn in 2022 (the capacity to be achieved through expanding its Solikamsk-3 and Berezniki-4 plants, as well as launching the Ust-Yayva and Polovodovo projects). According to Expert Rating Agency , Uralkali’s profitability is one of the highest in the fertilizer industry: 71% in 2012, despite an average annual export price of USD 370/tn. To illustrate the price dynamics: according to data published by Uralkali, with a reference made to Fertecon, Baltic FOB potassium chloride spot price levels were: USD 990/tn in 2008, USD 515/tn in mid-2012, USD 430/tn in mid-2013 and USD 288/tn at the beginning of 2014 (spot prices differ from long-term contract prices, but they reflect the market dynamics). In 2013 there was still some space for increased volumes, even if at the cost of prices, but with the level of prices recorded early in 2014 they clearly went down. According to preliminary estimates, Uralkali’s exports grew by 20% in 2013, year over year.

In the meantime, Belaruskali reduced both the output and the exports as well. According to Belstat statistics, in the period January-November 2013, Bela-ruskali’s production of potassium-based fertilizers dropped by 14.1%, year-on-year. The company produced 3.9 mln tn of fertilizers over 11 months in 2013. The export volume declined by 9.3% from January to October, falling to a level of 2.9 mln tn. Belaruskali’s trader, Belarusian Potash Company announced exports achieving 5.7 mln tn in 2013.

Notwithstanding the situation, Belaruskali is expecting to recover in 2014 and keeps expanding its capacity. In January 2014, the second block of Berezov-sky mine was commissioned (2 mln tn of potassium chloride). The 3rd block is expected to start operation in 2015, adding another 2 mln tn to the company’s total capacity.

One should not forget that a third major player – EuroChem – may appear on the market soon. Gremyachinskoe potassium salts deposit (Volgograd Oblast) is a priority project for the company, which plans to start production of potassium chloride in 2014 and reaching an annual capacity of 2.3 mln tn in 2015. The second stage of completion, scheduled for 2018, is expected to result in a total annual capacity of 4.6 mln tn.

EuroChem is planning to explore a potash deposit in Usolye (EuroChem-Usolskiy Potash). The commissioning is expected in 2017, the first stage of capac-ity development – 2.0 mln tn – is scheduled for 2018-2019, the second stage – 1.4 mln tn – for 2021, the total annual target capacity is to reach a level of 3.4 mln tn.

Although shifts in the project completion dates are very likely, the potential effect on the market should not be underestimated. While Gremyachinskoe’s output is gravitating towards the southern basin, export from the Perm region can be well expected to follow the Baltic direction. Hence, the potash segment appears to be the most capacious, while being the most risky segment of the mar-ket at the same time, both today and in the nearest decade as well.

The underwater part of the iceberg

Around 80% of the mineral fertilizer exports volume is shipped via sea ports in Russia, with the Baltic Sea being the largest logistic channel for Russian fertilizers. However, an analysis reveals a gap between the volume of railway deliveries from production plants to sea ports and the volume of bulk cargo transshipment in the Russian ports, as well as the transit volume in the Baltic States.

Despite purely methodological complexities of the statistical account, the situation can be explained with one distinct tendency in recent years – growing volumes of packaged cargo – containerized and big-bagged. This category is classified as containerized or general cargo and is not covered by bulk statistics. Nevertheless, the volumes are significant: up to 2.8 mln tn in the Port of Saint Petersburg alone in 2012.

What can be expected in 2014

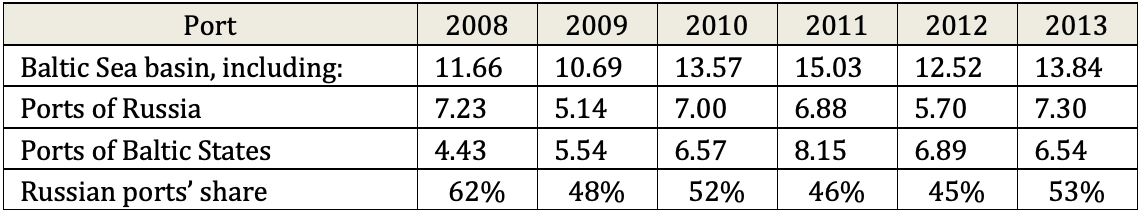

Russian fertilizers are streaming to Russian ports: in 2013 the turnover in Russian Baltic ports (mainly the Big Port of Saint Petersburg and Ust-Luga) in-creased by 1.6 mln tn, i.e. 28.2%, while the volume of deliveries to the ports of Baltic States dropped by 0.35 mln tn, i.e. 5.15%. The growth in cargo volumes handled by the Big Port of Saint Petersburg can be explained by the fact that Uralkali reduced its shipments to Ventspils and Nikolaev, while increasing the volume of freight dispatched via its own terminal at the Big Port of Saint Peters-burg, the Baltic Bulk Terminal by one time and a half, i.e. by 1.2 mln tn. Further-more, more shipments are received from another key customer of the port – PhosAgro. A part of the freight flow was re-oriented from the Port of Tallinn.

Nevertheless, there has not been any boom on the Russian market so far. Cargo owners are bound by long-term contracts with stevedoring companies and many producers have invested in the construction of their own terminals. As a result, freight flows not are transferred between terminals as actively as they could be. For example, the European Sulphur Terminal, currently handling fertilizers at the Port of Ust-Luga, is working below its throughput capacity, despite the significant rise in transshipment volumes noted in 2013 (nearly five times, up to 580 thou. tn).

Tab. 3. Transshipment of Russian fertilizer exports in Eastern Baltic ports (mln tn)

In all fairness, it has to be mentioned that although the share of Russian ports in the Baltic flow of fertilizers increased in 2013, it still remains below the level recorded in 2008. In 2009, the nadir year in exports, the Baltic States man-aged to overtake Russian freight flows. Thereafter, however, the tendency to transfer shipments to their “own” ports recovered more or less by luck.

In 2013, Russian ports won the battle for Russian fertilizers. The situation may change, however. There are two principal factors to this: development of new cargo handling capacities at ports and the potential redistribution of the potash fertilizers exports.

At the end of 2013, the completion of Uralchem’s terminal in Riga was announced. The project was a joint venture with SIA Rīgas tirdzniecības osta. Further expansion being possible, with its current cargo handling capacity of 2 mln tn, the terminal will be receiving Uralchem’s export freight flows, although services can also be provided to other exporters. With the existing export routes, Baltic ports are most convenient for the company – 89% of all seaborne shipments were dispatched via Baltic ports. Uralchem reoriented some of its freight flow to Riga in 2013, even before the terminal opened.

EuroChem is planning to build a fertilizer terminal in the Port of Ust-Luga, with a target capacity of 6 mln tn. The project has been postponed, awaiting completion of the company’s other developments (development of deposits). De-lays in the latter will result in an insufficient cargo volume in the nearest time span.

In connection with its general development programme (dredging and widening of the navigation channel), the Port of Klaipėda announced the expansion of three existing terminals’ capacity.

The fertilizer industry is witnessing another tendency today – new production plants are being constructed within port zones. This can also lead to new opportunities, such as handling other exporters’ production.

ICT Group is constructing an urea production plant in the industrial zone of Ust-Luga port, designed to produce up to 1.2 mln tn of granulated urea and up 350,000 tn of ammonia per year. The fertilizer transloading capacity should reach 4 mln tn. The possibility of building ammonia handling facilities is being considered. The plant will be constructed by Baltic Carbamide Plant, established by ICT Group.

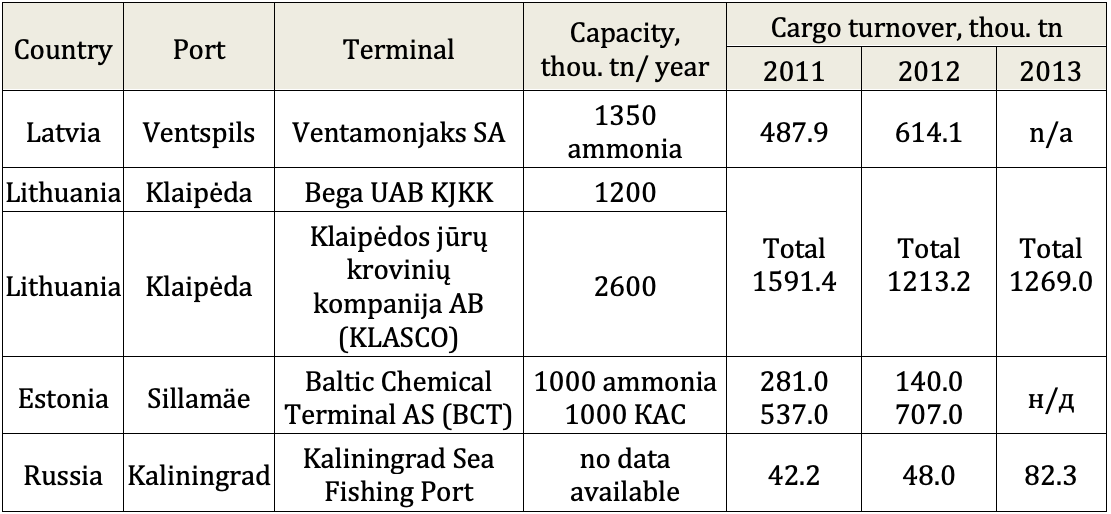

Transshipment of liquid mineral fertilizers is another segment where Russia cannot compete with the ports of Latvia, Lithuania, Estonia and Finland in the Baltic Sea region. Kaliningrad is the only Russian port here capable of handling liquid mineral fertilizers, but the liquid freight flow remains on a stable, but low level: 48 thou. tn in 2012, 82 thou. tn in 2013. Russian companies ex-ported 690 thou tn of liquid fertilizers via the ports of the Baltic States in 2012 and 850 thou. tn in 2013.

Таb. 4. Basic characteristics of terminals handling liquid fertilizers in the Eastern Baltic ports

As far as the potash segment is concerned, the question of a possible reunion between Uralkali and Belaruskali is becoming the new topic of the day. The issue remains unsolved as of the beginning of 2014 and the parties are express-ing no such intentions in their official statements. Nevertheless, if collaboration resumed, it might result in strengthening of the potash market overall (increasing the level of prices) due to policy consent; therefore, this course of action can-not be excluded. The spectrum of potential impacts is hard to envisage, though. Possibly, Uralkali’s key port turnover will stabilize, while the turnover in the ports of Baltic States may increase owing to Belaruskali.